topcazyno1.site

Prices

Safest Money Transfer Apps

Most money transfer apps are secure and have preventive measures attached to them to ensure your safety. Send money transfers to Mexico from the United States 24/7 using Western Union. Learn how to send money online, in person or through our international app. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. Other domestic money transfer apps. Peer-to-peer (P2P) payment apps like Venmo, Cash App, and Zelle allow you to add a linked bank account. Ria makes it easy for you to track any transfer using your PIN or order number. With our app, you can check rates, enjoy faster repeat transfers, and find the. Another great app for instant money transfers is Revolut. This money transfer app doesn't just stop at sending and receiving money. It is also a digital bank. Be aware of the latest scams and NEVER send money using a P2P app to: · Anyone calling or texting who claims to be from a government agency · Banks and utility. Zelle, CashApp, and Venmo are popular money transfer apps that allow you to send and receive money to and from other individuals instantly. Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud monitoring. Most money transfer apps are secure and have preventive measures attached to them to ensure your safety. Send money transfers to Mexico from the United States 24/7 using Western Union. Learn how to send money online, in person or through our international app. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. Other domestic money transfer apps. Peer-to-peer (P2P) payment apps like Venmo, Cash App, and Zelle allow you to add a linked bank account. Ria makes it easy for you to track any transfer using your PIN or order number. With our app, you can check rates, enjoy faster repeat transfers, and find the. Another great app for instant money transfers is Revolut. This money transfer app doesn't just stop at sending and receiving money. It is also a digital bank. Be aware of the latest scams and NEVER send money using a P2P app to: · Anyone calling or texting who claims to be from a government agency · Banks and utility. Zelle, CashApp, and Venmo are popular money transfer apps that allow you to send and receive money to and from other individuals instantly. Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud monitoring.

PayPal: Best for freelancers and business owners · Venmo: Best for everyday users · Zelle: Best for fee-free transfers · Cash App: Best for cryptocurrency. If you're looking for a robust P2P money transfer application, then Cash App may fit the bill. Aside from letting you send and receive money using a linked bank. When you want to send a contact money, you can do so using either your Cash App balance or a linked credit card, debit card, or bank account. In addition to. Other domestic money transfer apps. Peer-to-peer (P2P) payment apps like Venmo, Cash App, and Zelle allow you to add a linked bank account. The WorldRemit app is one of the best International money transfer apps available. It's FREE and open for you to send money 24/7, days a year - wherever. Send money securely online and through your mobile device with SAFE Pay. Money moves directly from your bank account into your friend's or family member's bank. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Zelle and other money transfer apps are generally safe and make sending and receiving funds quick and easy. However, it is the quick transfer of funds that. The apps of most major banks, for example, include Zelle®, a fast and safe way to send money to friends and family. If your bank doesn't use Zelle®, there. Money transfer apps like Zelle, Cash App, and Venmo make it possible to send money without large fees. For instance, you might be able to send money from a. Remitly is secure and fast, with great exchange rates in + currencies–no fees for recipients and low fees for sending. And with a guaranteed delivery time. Sendwave - Send Money 4+. Money Transfer. Chime Inc. # in Finance. •. Best International Money Transfer Apps · 1. Quick Comparison Table · 2. Wise – Small transfers · 3. CurrencyFair – First 10 free · 4. Revolut – Most like a bank · 5. 1. Wise (formerly Transferwise). Wise was designed to make it more affordable, quicker, and simpler to do foreign currency transactions. You can open a. Several online money transfer apps are considered reliable, such as PayPal, Venmo, Cash App, and TransferWise. Each app has its own features and. For person-to-person transfers, if both parties have an iPhone, most secure and simplest to use is Apple Pay Cash. It is built into the iOS, so. Are Money Transfer Apps Safe? The short answer is yes. Most money transfer apps have strong security protections, such as two-factor authentication, to ensure. You may have heard of mobile payment apps like Venmo, Cash App, or PayPal that let you send and receive money through your smartphone (or online). If you haven'. P2P payment apps are safe and there should be no hesitancy in their security, but they're not foolproof. A mistake could cost you when sending money. “Because. #2 Western Union: Best App For Small Money Transfers & Cash · Currencies: + · Minimum transfer: £1 · Maximum transfer: £50k · Deposit methods: Bank transfer.

Personal Loan Percentage

The average overall interest rate for personal loans is %, same as last week. You can use a personal loan to pay for anything from a wedding to home. Representative example of repayments terms for an unsecured personal loan: For $12, borrowed over 36 months at % APR, the monthly payment is $ This. The Annual Percentage Rate (APR) varies based on credit score, loan amount, purpose and term. Minimum loan amount is $1, and loan terms range from 12 to. But personal loan interest rates can range from 6% to 36%, depending on your credit score, income, current debts, and other factors, such as loan term and. Annual Percentage Rate, Daily Periodic Rate ; %, ; You may estimate your payment by taking your loan balance at the time of your last advance and. What is the Average Interest Rate on a Personal Loan? The interest rates offered on personal loans by most lenders usually range between % to 26% p.a. Free personal loan calculator that returns the monthly payment, real loan cost, and the APR after considering the fee, insurance, interest of a personal. Bottom line. History tells us that taking out loans at 5% to 10% APR might not be a big deal if you can handle the financial obligation. However, the best. One-time fee of % to % of your loan amount based on your credit rating, and charged only when you receive your loan. ratefee-apr. Annual Percentage Rate. The average overall interest rate for personal loans is %, same as last week. You can use a personal loan to pay for anything from a wedding to home. Representative example of repayments terms for an unsecured personal loan: For $12, borrowed over 36 months at % APR, the monthly payment is $ This. The Annual Percentage Rate (APR) varies based on credit score, loan amount, purpose and term. Minimum loan amount is $1, and loan terms range from 12 to. But personal loan interest rates can range from 6% to 36%, depending on your credit score, income, current debts, and other factors, such as loan term and. Annual Percentage Rate, Daily Periodic Rate ; %, ; You may estimate your payment by taking your loan balance at the time of your last advance and. What is the Average Interest Rate on a Personal Loan? The interest rates offered on personal loans by most lenders usually range between % to 26% p.a. Free personal loan calculator that returns the monthly payment, real loan cost, and the APR after considering the fee, insurance, interest of a personal. Bottom line. History tells us that taking out loans at 5% to 10% APR might not be a big deal if you can handle the financial obligation. However, the best. One-time fee of % to % of your loan amount based on your credit rating, and charged only when you receive your loan. ratefee-apr. Annual Percentage Rate.

%% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. The average personal loan interest rate is currently %. Every month, Investopedia analyzes data from 16 lenders to determine the average interest rate. Minimum payments due will be based on a percentage of the outstanding principal balance at the end of the billing cycle. The minimum monthly payment will equal. APRs for loans amounts from $1, to $35, with repayment terms from 6 to 60 months currently range from % to %. Personal Line of Credit Annual. Repay a personal loan in terms of months. Rates range from % to % Annual Percentage Rate (APR)Footnote 6, which includes a relationship discount. month term: Maximum fixed % APR; based on a loan amount of $2, monthly payment is $ (8). Minimum annual percentage rate (APR) is based on a. SS) APR - Annual Percentage Rate is subject to change and may vary depending on credit rating. T) Payment per $1, balance is based on the interest rate. Interest rates on personal loans are expressed as a percentage of the principal—the amount you borrow. Your personal loan APR will be decided based on your credit score, credit history and income, as well as other factors like the loan's size and term. Even a loan with a low interest rate could leave you with monthly payments that are higher than you can afford. Some personal loans come with variable interest. The personal loan interest rates range between % pa and 44% pa depending on the loan amount availed by you, your credit score, and repayment tenure. HDFC Bank Personal Loan comes with competitive interest rates, allowing you to save money and enjoy affordable EMIs. Personal loan Interest rates starting at % at Axis Bank. Visit our website & apply for a low interest personal loan with minimal paperwork & quick. Average personal loan rates* on 3-year loans were at % APR, down from % last week and up from % a year ago. Average personal loan rates* on Personal Loans Schemes - Interest Rates · वैयक्तिक ऋण योजनाएं · %* p.a. onwards · Start From · % p.a.* · % p.a. · % p.a. · Starts From %*. Personal Loans interest rate starting at % p.a. Avail an unsecured loan at EMI as low as Rs / lakh at the lowest personal loan interest rate at. Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. The average personal loan interest rate is dependent on several factors, including the amount borrowed, credit history, and income, among others. Flexible loan amounts. You can get a personal loan from $1, to $50,⁵. ; Fixed rates and terms. Choose between personal loans in 3 or 5 year terms, with.

Best Transferable Car Warranty

Global Warranty is Canada's leading independent extended vehicle warranty provider with a hassle free claims process & ultimate auto warranty protection. If you purchase a vehicle that's still covered under its Year/,mile limited powertrain warranty, you — the subsequent owner — will enjoy many of the. Mitsubishi offers the best length of vehicle warranty, with Kia and Hyundai close behind. Mitsubishi covers 5 years/, km for the comprehensive and the. For the best experience, we recommend upgrading or changing your web browser. Does the New Vehicle Limited Warranty transfer to the new owner if I sell my. As long as a vehicle is sold within its original year/,mile warranty coverage term, then the second owner will receive nearly the same benefits for up. Fully transferable to new Owners. Already a Buick Owner? View your If I sell my car, does the new vehicle limited warranty transfer to the new owner? Buyers may be skeptical about purchasing a used car, so one that comes with a guarantee can help alleviate some of that worry. Any warranty is better than none. Experience the peace of mind that comes with high quality car service. Learn more about our warranty options including Powertrain, New Vehicle, & more. A transfer fee of $ plus applicable taxes must be paid to Enusrall within 10 business days of the sale in order to initiate a Warranty Transfer. Global Warranty is Canada's leading independent extended vehicle warranty provider with a hassle free claims process & ultimate auto warranty protection. If you purchase a vehicle that's still covered under its Year/,mile limited powertrain warranty, you — the subsequent owner — will enjoy many of the. Mitsubishi offers the best length of vehicle warranty, with Kia and Hyundai close behind. Mitsubishi covers 5 years/, km for the comprehensive and the. For the best experience, we recommend upgrading or changing your web browser. Does the New Vehicle Limited Warranty transfer to the new owner if I sell my. As long as a vehicle is sold within its original year/,mile warranty coverage term, then the second owner will receive nearly the same benefits for up. Fully transferable to new Owners. Already a Buick Owner? View your If I sell my car, does the new vehicle limited warranty transfer to the new owner? Buyers may be skeptical about purchasing a used car, so one that comes with a guarantee can help alleviate some of that worry. Any warranty is better than none. Experience the peace of mind that comes with high quality car service. Learn more about our warranty options including Powertrain, New Vehicle, & more. A transfer fee of $ plus applicable taxes must be paid to Enusrall within 10 business days of the sale in order to initiate a Warranty Transfer.

FULLY TRANSFERABLE TO NEW OWNERS. ALREADY A GMC OWNER? View your If I sell my car, does the new vehicle limited warranty transfer to the new owner? If you're shopping for a used car Best Warranty.” If you're considering a new or used Hyundai, you may be wondering, “Is the Hyundai warranty transferable?”. Protection Plans. Provide additional protection on top of the manufacturer's warranty. If I sell my car, do the warranties transfer to the new owner? Yes. vehicle repair costs after your New Vehicle Limited Warranty has expired. Gas Coverage is % Transferable. Ford Protect Extended Service Plan is. Obvi has the only extended warranty in Canada that allows transfer through a dealer trade. Visit any repair facility you choose to make a claim. You can cancel. The Kia warranty is transferable to a second owner. While a Soul's used Kia warranty varies a bit from the coverage provided for a brand new model, it still. Warranty has expired. Gas / Diesel. Most Popular. PremiumCARE. +. Components Ford Protect Extended Service Plan is transferable and may increase the. Global Warranty and LGM Secure Drive Warranty are most flexible and comprehensive warranty program. Any year, any make, any model. But there's a catch the warranty doesn't last forever. But you can find the best car warranty reviews to help make your decision. Factory warranties last for a. After expiration, the Used Vehicle Limited Warranty provides additional coverage of 1 year or 10, miles. If the Basic Vehicle Limited Warranty has already. Our top pick for auto warranty · Mileage covered: Up to , miles · Longest term: Up to 8 years · Money-back guarantee: 30 days · Coverage options: 6 plans. best. The warranty is fully transferable and ultimately increases the resale value of your vehicle. Standard Warranty Coverage. Covered Parts. Years. Carchex is the best extended warranty provider for used cars, as it offers coverage for cars up to 10 years old, with up to , miles on them. The Gold plan. If I sell my car, do the warranties transfer to the new owner? Yes. Those For best results, adhere to the following protocol: 1. Discuss your. To find the best offers and nearby inventory, we need to find your location. Is Nissan Warranty Transferable? Nissan warranties are generally. The vehicle must be sold within the coverage period of its Year/,mile limited powertrain warranty coverage. The second owner receives much of the same. The majority of extended car warranty companies are willing to transfer these coverage plans without any issues. The warranty follows the vehicle rather than. Provides additional protection on top of your Buick's standard warranty. If I sell my car, does the new vehicle limited warranty transfer to the new owner? The 6-year/,mile Powertrain Limited Warranty also includes courtesy transportation and roadside assistance. It's also transferable to future owners. Kia. Review our Elite Extended Protection plans and contact your local Retailer for long-term protection that goes beyond your vehicle's Limited Warranty. VIEW.

How To Get Debt Consolidation With Bad Credit

So if you consolidate multiple credit card debts into one new personal loan, your credit utilization ratio and credit score could improve. Payment History. If. A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month —. Debt Consolidation Loan Alternatives · Home Equity Line of Credit. Commonly known by the acronym HELOC, home equity lines of credit essentially allow you to use. A debt consolidation loan is an unsecured personal loan that you take out to consolidate multiple lines of credit card debt and/or other debts with high. High interest loans are one way for people with bad credit to consolidate debts into one monthly payment, but you risk staying in debt for years longer than. How to Get a Debt Consolidation Loan with Bad Credit · Check credit score. One way to save yourself a few hard inquiries into your credit is to know your credit. For debt consolidation with lower credit, consider looking into nonprofit credit counseling agencies. They can negotiate lower interest rates. The credit score you need to qualify for a debt consolidation loan depends on the lender. Depending on the lender, some offer loans to borrowers with credit. Consider getting a secured loan or working with a lender who specializes in debt consolidation loans for low credit. Are there alternatives to a debt. So if you consolidate multiple credit card debts into one new personal loan, your credit utilization ratio and credit score could improve. Payment History. If. A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month —. Debt Consolidation Loan Alternatives · Home Equity Line of Credit. Commonly known by the acronym HELOC, home equity lines of credit essentially allow you to use. A debt consolidation loan is an unsecured personal loan that you take out to consolidate multiple lines of credit card debt and/or other debts with high. High interest loans are one way for people with bad credit to consolidate debts into one monthly payment, but you risk staying in debt for years longer than. How to Get a Debt Consolidation Loan with Bad Credit · Check credit score. One way to save yourself a few hard inquiries into your credit is to know your credit. For debt consolidation with lower credit, consider looking into nonprofit credit counseling agencies. They can negotiate lower interest rates. The credit score you need to qualify for a debt consolidation loan depends on the lender. Depending on the lender, some offer loans to borrowers with credit. Consider getting a secured loan or working with a lender who specializes in debt consolidation loans for low credit. Are there alternatives to a debt.

You can consolidate your debts by applying for a consolidation loan. Or if a loan isn't right for you, an alternative can be enrolling your credit card debt. You can consolidate your debts by applying for a consolidation loan. Or if a loan isn't right for you, an alternative can be enrolling your credit card debt. It won't affect your credit score. Apply now Learn more. Home equity loan. Discover fixed rates and payments to help work toward debt. Instant offers: If approved, see personalized loan offers in seconds · Debt payoff: Eliminate high-interest credit card debt · Low payments: Reduce the cost of. How to get a debt consolidation loan online ; Get your rate. It takes less than 5 minutes to check your rate—and it won't affect your credit score.¹. Upstart. Get pre-qualified for a debt consolidation loan instantly with just a few questions. You'll immediately see what rate you may be eligible for, without a hit. Get a personalized credit consolidation loan quote in 60 seconds. Fast, easy, safe. Apply for a debt consolidation loan and view your rate with our secure. Low Minimum Score Lenders. Some lenders will offer consolidation loans to those with lower minimum credit scores. A score of less than typically. Depending on your credit profile, a debt consolidation loan could help improve your credit by diversifying your credit mix and showing that you can make on-time. That's why P2P Credit offers bad credit debt consolidation loans to those who have poor to average credit. Even though you have bad credit, you may still be. Even with bad credit, it can be possible to qualify for a debt consolidation loan. Debt consolidation is when you use a loan, like a personal loan, to pay off. How to get a debt consolidation loan with LendingTree · Check your credit score. Get your free credit score with LendingTree Spring. · Figure out how much you. The only problem is that most debt consolidation solutions require you to have a good credit score to qualify. If you have bad credit, you either can't qualify. By doing so, their creditworthiness can offset the impact of your bad credit, making it easier to secure the loan. It's important to note that your co-signer. There are primarily three places you can get a debt consolidation loan with bad credit: Banks, credit unions, or online lenders. Visit your local bank or credit. Combine balances and make one set monthly payment with a debt consolidation loan Apply when you're ready and get a quick credit decision, typically the same. Debt consolidation is when someone takes out a loan and uses it to pay off other loans—often high-interest debt like credit cards and car loans. You try to find. Do you have high-interest, unsecured debt from credit cards and personal loans following you around? Consider combining into a single, low-rate debt. Going Deeper on the Best Debt Consolidation Loans for Bad Credit · Upstart: Our top pick · Upgrade: Best discounts · Avant: Fastest delivery · Universal Credit. If anything looks amiss, report it to the credit bureau and get it fixed ASAP. This can help improve your score and your chances of qualifying. Suppose you're.

Collateral Life Insurance

Using your life insurance policy as collateral? Fill out and submit this form, and receive a confirmation in the mail. Collateral Assignment of Life Insurance Policy Proceeds for Medicaid Eligibility;. HB HB enacts new law requiring the Kansas Department of Health. A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to. Collateral assignment safeguards the amount payable to the lender in that the lender gets the amount that was loaned out. This plays out well following the. “Company” as referred to herein, is Massachusetts Mutual Life. Insurance Company, and/or MML Bay State Life Insurance Com-. The collateral of a life insurance policy loan is the simple process of assigning a lender as the temporary primary beneficiary of your insurance, making them. You can use the death benefit as collateral via a form every carrier has called a collateral assignment. Wether that satisfies the lenders. The collateral of a life insurance policy loan is the simple process of assigning a lender as the temporary primary beneficiary of your insurance, making them. The guidelines cover important aspects such as determining the policy's cash surrender value, establishing the assignment amount, and defining the rights and. Using your life insurance policy as collateral? Fill out and submit this form, and receive a confirmation in the mail. Collateral Assignment of Life Insurance Policy Proceeds for Medicaid Eligibility;. HB HB enacts new law requiring the Kansas Department of Health. A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to. Collateral assignment safeguards the amount payable to the lender in that the lender gets the amount that was loaned out. This plays out well following the. “Company” as referred to herein, is Massachusetts Mutual Life. Insurance Company, and/or MML Bay State Life Insurance Com-. The collateral of a life insurance policy loan is the simple process of assigning a lender as the temporary primary beneficiary of your insurance, making them. You can use the death benefit as collateral via a form every carrier has called a collateral assignment. Wether that satisfies the lenders. The collateral of a life insurance policy loan is the simple process of assigning a lender as the temporary primary beneficiary of your insurance, making them. The guidelines cover important aspects such as determining the policy's cash surrender value, establishing the assignment amount, and defining the rights and.

You can use collateral assignment to borrow money at favorable rates with whole life insurance while your policy builds cash value and death benefit! Policy Ownership: The life insurance policy remains owned by the policyholder. · Collateral Assignment: The policyholder and the lender sign a collateral. Introduction. As a general rule, premiums paid under a life insurance policy are not an allowable deduction for income tax purposes. This assignment is made and the Policy is to be held as collateral security for any and all liabilities of the undersigned, or any of them, to the Assignee. A collateral assignment is a legal arrangement where the policyholder assigns the benefits of their policy to a lender as collateral for a loan. Learn more! This clever maneuver is known as a collateral assignment of life insurance. It's a deal between you and your lender where your life insurance policy. Not all life insurance policies are accepted as collateral. Typically, a whole or universal life insurance policy is acceptable, while term life insurance isn'. Follow the screen prompts. You can also mail to: USAA Life Insurance Company. USAA Life Insurance Company of New York. Fredericksburg Road. You can use collateral assignment to borrow money at favorable rates with whole life insurance while your policy builds cash value and death benefit! Throughout this form, “Empire Life” means The Empire Life Insurance Company. I authorize: Empire Life to carry out this collateral assignment in. Whether the insurance policy is only a minor component or the principal component of the collateral, the lender must understand the law behind obtaining liens. Assignment of Life Insurance Policy or Annuity Contract as Collateral Security. General Information – Required. Policy / Contract No.: Insured Name (Life. Collateral Assignment of Life Insurance Policy. A. FOR VALUE RECEIVED, I (we) any supplemental contracts, issued by UNITED OF OMAHA LIFE INSURANCE COMPANY . Most businesses typically accept life insurance as collateral as they can guarantee funds if the borrower dies or defaults. Used by a client to transfer the proceeds of a life insurance policy to MASC, as a collateral for a loan. Department/Crown: Agriculture. Most businesses typically accept life insurance as collateral as they can guarantee funds if the borrower dies or defaults. ASSIGNMENT OF LIFE INSURANCE POLICY AS COLLATERAL*. Notice: Should you have any question as to the legal effect of any provisions of this document. The insurance company hereby acknowledges that by recording this Irrevocable Collateral Assignment of Life Insurance Proceeds, it agrees to accept and abide by. If you have permanent life insurance, you may be able to use your policy's cash value as collateral to take out a loan. You can request a loan from your. When creditors may require a business to purchase life insurance as additional collateral to protect the creditors' interests. This type of insurance is.

Best Island Mount Range Hood

I'm looking for a 30" or 36" ISLAND range hood (not wall mount), stainless steel finish with no glass (so many options with the glass). Island Range Hoods · KitchenAid® 36'' Black Stainless Steel with PrintShield™ Finish Island Mount Canopy Range Hood · Sale $1, · Zephyr Anzio 36" Stainless. The 5 Best Island Range Hoods of · Cosmo COSICS Stainless Steel Island Range Hood · Cosmo COSISS90 Digital Touch Stainless Steel Island Range Hood. Best IM32ISP 40 Inch Island-Mount Range Hood with CFM Internal Blower: Stainless Steel. Island Mount, Task Light, Halogen Lighting, Auto Shutoff. However, an island ceiling mount can be hung from peninsula wall cabinets. At Spencer's TV & Appliance, we have island range hoods from leading brands in the. AKDY 30 in. Island Mount Range Hood, 4-Speed Fan and LED Lights in Stainless Steel, Convertible Range Hood Ducted to Ductless with 2-Sets of Carbon Filters. Bertazzoni Professional Series 36" Stainless Steel Island Range Hood · $1, · Elica Techne Series Cingoli 36" Stainless Steel with Black Glass Island Range. Vent-A-Hood® 54" Stainless Steel Euro-Style Island Range Hood · $7, · Amana® 36" Stainless Steel Island Mount Range Hood · $1, · Bertazzoni Professional. Futuro Futuro offers over models of stylish, effective, and beautifully crafted Italian island range hoods that use only the highest quality materials and. I'm looking for a 30" or 36" ISLAND range hood (not wall mount), stainless steel finish with no glass (so many options with the glass). Island Range Hoods · KitchenAid® 36'' Black Stainless Steel with PrintShield™ Finish Island Mount Canopy Range Hood · Sale $1, · Zephyr Anzio 36" Stainless. The 5 Best Island Range Hoods of · Cosmo COSICS Stainless Steel Island Range Hood · Cosmo COSISS90 Digital Touch Stainless Steel Island Range Hood. Best IM32ISP 40 Inch Island-Mount Range Hood with CFM Internal Blower: Stainless Steel. Island Mount, Task Light, Halogen Lighting, Auto Shutoff. However, an island ceiling mount can be hung from peninsula wall cabinets. At Spencer's TV & Appliance, we have island range hoods from leading brands in the. AKDY 30 in. Island Mount Range Hood, 4-Speed Fan and LED Lights in Stainless Steel, Convertible Range Hood Ducted to Ductless with 2-Sets of Carbon Filters. Bertazzoni Professional Series 36" Stainless Steel Island Range Hood · $1, · Elica Techne Series Cingoli 36" Stainless Steel with Black Glass Island Range. Vent-A-Hood® 54" Stainless Steel Euro-Style Island Range Hood · $7, · Amana® 36" Stainless Steel Island Mount Range Hood · $1, · Bertazzoni Professional. Futuro Futuro offers over models of stylish, effective, and beautifully crafted Italian island range hoods that use only the highest quality materials and.

Amana is renowned for its commitment to quality and performance, and their island range hoods are no exception. Designed to seamlessly blend into your kitchen. Choosing the right size for an island ceiling mount range hood is essential. In most cases, you'll need a size that's six inches larger than your cooking gadget. Amana® 36" Stainless Steel Island Mount Range Hood · Sale $1, · Bertazzoni Professional Series 36" Stainless Steel Island Range Hood · $1, · Bertazzoni. Futuro Futuro 36″ Livorno Island Range Hood. Futuro Futuro's Inch Livorno Stainless Steel Island Range Hood brings a professional look to your kitchen with a. Island Range Hoods · Zephyr · ZLINE · GE Profile · KitchenAid · Windster Hoods · Whirlpool · Bosch · Miele. If you're elevating your kitchen to pro, luxury status, a Wolf island range hood supplies the power and style you need. Don't forget to read our island range. ZLINE Island Mounted Range Hoods deliver superior performance and aesthetics - available in Stainless Steel, Black Stainless Steel, Wood, Copper. Island Range Hoods · ZLINE Kitchen And Bath · Broan NuTone LLC · Proline Range Hoods · Amoretti Brothers · Ancona. Get more from your island-mount range hood with Browse our other kitchen ventilation systems to find one that best fits your layout and cooking needs. Remote Blower Island Mount Range Hood in Stainless Steel (GL2i-RS) ZLINE 36 in. ZLINE. Regular price $1, Sale price$1, Save $ Bertazzoni Island Range Hoods: Elevate your kitchen with Bertazzoni's stylish and efficient island range hoods, blending Italian craftsmanship with cutting-edge. Bekins is one of the best places to buy island range hoods. We have a wide selection of models to choose from, and they are all of the highest quality. Island Range Hoods ; Zephyr Core Collection Anzio 36" Stainless Steel Island Range Hood · Zephyr Core Collection Anzio 36" Stainless Steel Island Range Hood · ZAZ-. Amana® 36" Stainless Steel Island Mount Range Hood · Sale $1, · Bertazzoni Professional Series 36" Stainless Steel Island Range Hood · $1, · Bertazzoni. Shop the Best Island Range Hood Brands. Bertazzoni, Dacor, Miele, Thermador, Vent-a-Hood, and Zephyr are all well-known brands when it comes to island range. If you need quality ventilation at a budget-friendly price tag, a Whirlpool island range hood accommodates. To deck out your pro-chef kitchen and make a. The COSMO ICS is a solid choice if you're looking for a no-nonsense island range hood. Although it might not be as powerful as the other two range hoods. ZLINE Island Mounted Range Hoods deliver superior performance and aesthetics - available in Stainless Steel, Black Stainless Steel, Wood, Copper. Island mount range hoods are designed for use over your island cooktop and are hung from the ceiling as a freestanding hood. Island range hoods are finished. I had a similar issue and ended up getting a ceiling-mounted range hood for my island. Best Range Hood Insert · Best Under Cabinet Range.

Solar Power Batteries Cost

The first ~10kwh battery from solaredge, Franklin, enphase, etc is often around $15k installed with all the parts. That only leaves you with $5k. Low wholesale solar battery prices for on-grid and off-grid energy storage. Deka Solar Sealed Batteries Sealed maintenance-free batteries using gel electrolyte. It usually costs about $9, to install solar batteries. Where you live helps determine if you'll make that money back over time. Lithium Ion (LiFePO4) Solar Battery for Solar Panels and Storage ; 12V Ah LBS Deep Cycle Battery – 12v Ah Lithium Battery · Original price was: $. The average price for 12v Batteries ranges from $10 to $ Related Searches. Battery pricing explained. Battery cost estimates: ** The battery upfront cost estimate is based on various distributors and wholesalers. The cost does not. For instance, EV batteries currently cost around USD / kWh. The lowest battery storage price I can find is around USD, and actual. In general, a solar battery bank can cost between $10, to $25, for 10 to 25 kilowatt hours of power. (The US Department of Energy says solar batteries can. Solar batteries can cost anywhere from $ up to $30,, but most people pay between $6, and $12,, with an average cost of around $10, How we get. The first ~10kwh battery from solaredge, Franklin, enphase, etc is often around $15k installed with all the parts. That only leaves you with $5k. Low wholesale solar battery prices for on-grid and off-grid energy storage. Deka Solar Sealed Batteries Sealed maintenance-free batteries using gel electrolyte. It usually costs about $9, to install solar batteries. Where you live helps determine if you'll make that money back over time. Lithium Ion (LiFePO4) Solar Battery for Solar Panels and Storage ; 12V Ah LBS Deep Cycle Battery – 12v Ah Lithium Battery · Original price was: $. The average price for 12v Batteries ranges from $10 to $ Related Searches. Battery pricing explained. Battery cost estimates: ** The battery upfront cost estimate is based on various distributors and wholesalers. The cost does not. For instance, EV batteries currently cost around USD / kWh. The lowest battery storage price I can find is around USD, and actual. In general, a solar battery bank can cost between $10, to $25, for 10 to 25 kilowatt hours of power. (The US Department of Energy says solar batteries can. Solar batteries can cost anywhere from $ up to $30,, but most people pay between $6, and $12,, with an average cost of around $10, How we get.

10 kWh Solar Battery ; 11 kWh Sol-Ark Carbon AGM Battery PCC Sol-Ark · $6, · SA-PCC ; kWh SolarEdge Energy Bank Battery. SolarEdge · $7, Residential solar batteries range in price from $$ or more, though many factors contribute to the cost, such as battery type and energy usage. Lithium Ion Solar Batteries ; Sold out. or as low as $/mo with · $8, Original price $9, · $9, ; Save up to $3, Save $ · or as low. Solar Battery ; $ - $ Min. order: watts ; $ $ Min. order: 1 piece ; $ - $ Min. order: 10 pieces ; $ - $ Min. $2, · or from $ per month for 18 months with more info ; $5, · or from $ per month for 36 months with more info ; $6, Strong & Durable Structure ; 24V AH Lithium Ion Lifepo4 battery · 1, Original price was: $1, ; 48v Ah 5 kWh battery energy storage · 1, Solar batteries are very affordable, with costs ranging from around $20 to over $5, depending on the capacity and the technology. It's important to not just. But as a starting point, the price of solar battery storage starts at $ or around $ a month over 5 years for a smaller Enphase system, while larger. The cost of solar panel battery storage varies based on factors like capacity, technology, and brand. On average, prices can range from a few. Solar batteries can cost anywhere from $ up to $30,, but most people pay between $6, and $12,, with an average cost of around $10, Most. The main downside of Lithium-ion batteries is that they are expensive. They cost as much as double the price of lead-acid batteries with similar energy storage. Key takeaways · A solar battery stores excess energy generated by your solar panels that you can use to power your home instead of using the grid. · Solar. The average solar battery installation cost is between $1, and $1, per kWh. The most popular batteries in this category are typically between $ each. Depending on the amount of power you use daily, you may need several of these. As a general rule of thumb, you could expect to pay about $11, for a kWh battery after incentives. Adding batteries to your solar system won't make your. Solar batteries average between $8,$10, or more (some are upwards of $30,), though many factors contribute to the cost. This is before any incentives. The cost of solar batteries ranges from $3, to well over $20, Here is a quick summary of the average costs of the different types of solar batteries on. At the net project cost of $12,, an FHP system with a single kWh aPower battery boils down to just over $ per kWh. This cost per kWh is a tad higher. Our solar line-up includes the most affordable price per kWh in energy storage solutions. Lithium-ion batteries can also store about 50% more energy than lead-.

Passive Investing

A passive strategy would allow you to reap the benefits of an upward market. At the same time, active investing means you can enjoy downside protection and. Passive investing is an investment strategy that aims to maximise returns for investors by minimising costs. Find out more. Your goal would be to match the performance of certain market indexes rather than trying to outperform them. Passive managers simply seek to own all the stocks. 20 Unlike passive index funds, active funds can invest in non-index stocks in an effort to boost returns. They have the time and resources to do due diligence. We build passive income and equity for our investors through low-risk real estate investments in the hottest real estate markets in the United States. A tax-managed separately managed account (SMA) might be your better choice. ETFs pool investors' money in a fund that invests in stocks, bonds or other assets. Passive investors are inherent price takers – they buy or sell only when cash flows in or out require it, and they do so at whatever the prevailing price is. If. Passive investment strategies have outperformed, saving investors a fortune in fees, but it doesn't always pay to be lazy. Passive management (also called passive investing) is an investing strategy that tracks a market-weighted index or portfolio. A passive strategy would allow you to reap the benefits of an upward market. At the same time, active investing means you can enjoy downside protection and. Passive investing is an investment strategy that aims to maximise returns for investors by minimising costs. Find out more. Your goal would be to match the performance of certain market indexes rather than trying to outperform them. Passive managers simply seek to own all the stocks. 20 Unlike passive index funds, active funds can invest in non-index stocks in an effort to boost returns. They have the time and resources to do due diligence. We build passive income and equity for our investors through low-risk real estate investments in the hottest real estate markets in the United States. A tax-managed separately managed account (SMA) might be your better choice. ETFs pool investors' money in a fund that invests in stocks, bonds or other assets. Passive investors are inherent price takers – they buy or sell only when cash flows in or out require it, and they do so at whatever the prevailing price is. If. Passive investment strategies have outperformed, saving investors a fortune in fees, but it doesn't always pay to be lazy. Passive management (also called passive investing) is an investing strategy that tracks a market-weighted index or portfolio.

Meet the managing partners dedicated to protecting your investment. Dan Handford Headshot Dan Handford Managing Partner View Bio. Passive investing is a buy-and-hold strategy which often mirrors market returns. Passive investors invest broadly, diversify, control risk, and keep fees. While passive investment promotes a long-term 'buy and hold' strategy, active investment seeks to outperform the market through in-depth research and timely. Key Takeaways · Passive investing broadly refers to a buy-and-hold portfolio strategy for long-term investment horizons with minimal trading in the market. Passive investing is a long-term investment strategy that focuses on buying and holding investments for the long term. Its goal is to build wealth gradually. A tax-managed separately managed account (SMA) might be your better choice. ETFs pool investors' money in a fund that invests in stocks, bonds or other assets. There is no “best” passive income investing strategy. Indeed, different kinds of passive income investments have their own pros and cons to consider. Active strategies have tended to benefit investors more in certain investing climates, and passive strategies have tended to outperform in others. For example. An active investment strategy involves using the information acquired by expert stock analysts to actively buy and sell stocks with specific characteristics. Passive investments are generally implemented in two distinct structures: index mutual funds and ETFs. The goal of passive investing is not to outperform the. Get a diversified low-fee portfolio managed by a team of experts so you can get to your goals faster. Find the portfolio that fits your investing style and. Generally speaking, any passive income paid in the form of dividends is the best passive income in Canada. This is because dividend income is taxed at a lower. In this piece, we attempt to answer a number of questions we have gotten from clients about the impacts that rising levels of passive investing may have had on. The Dirty Little Secret of Passive Investing Passive investments have a dirty little secret: Their gross returns are materially depressed by implicit. A passive investing strategy aims to grow your wealth, fulfill your long-term financial goals, and combat costly investing mistakes. Active investing is generally a strategy focused on trying to beat the performance of the market. Passive investing, meanwhile, seeks to track or mirror a. Active – Investments, such as equity or fixed income-based mutual funds and multi asset funds, seek to generate higher returns than the market average. Index-based, or “passive,” investing occurs through investments in index-linked products such as index mutual funds, ETFs, and options contracts. The popularity of passive funds is growing, attracting investors with the promise of dramatically lower costs than actively managed alternatives. Passive investing: passive investing is following a market-weighted index without deviating from it to achieve extra returns (alpha).

Easy Ways To Make Cash Now

Selling to local buyers is the fastest way to get your money. Post the items on Facebook swap groups, Craigslist, or other community sites to connect with. Fiverr is the best place to make money online for free. This website lets you offer any kind of service that you are good at and earn money from it. Getting. now that we are all isolated this is an awesome way to make money. Also when you complete a task sometimes you have to wait a few hours or sometimes just a. You can declutter and earn cash at the same time by selling your unwanted items on sites like Mercari, Poshmark and Offerup. They all make it easy to create a. Ads aren't the only way to make money on YouTube. Affiliate marketing and merch sales may be the quicker path to earning. Making Amazon your side hustle will. 4. How can I earn extra income from home? Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. If you need fast cash, then you need to find decent jobs that pay the same day. Fortunately, there are more options than you might expect, from delivering. One of my absolute favorite ways to make extra money from home is to create online courses. Now, this does take an upfront investment of time. But, as any other. For the purchases you may be already making — like on groceries, food delivery or streaming — you could earn cash back. That way, you're not leaving any money. Selling to local buyers is the fastest way to get your money. Post the items on Facebook swap groups, Craigslist, or other community sites to connect with. Fiverr is the best place to make money online for free. This website lets you offer any kind of service that you are good at and earn money from it. Getting. now that we are all isolated this is an awesome way to make money. Also when you complete a task sometimes you have to wait a few hours or sometimes just a. You can declutter and earn cash at the same time by selling your unwanted items on sites like Mercari, Poshmark and Offerup. They all make it easy to create a. Ads aren't the only way to make money on YouTube. Affiliate marketing and merch sales may be the quicker path to earning. Making Amazon your side hustle will. 4. How can I earn extra income from home? Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. If you need fast cash, then you need to find decent jobs that pay the same day. Fortunately, there are more options than you might expect, from delivering. One of my absolute favorite ways to make extra money from home is to create online courses. Now, this does take an upfront investment of time. But, as any other. For the purchases you may be already making — like on groceries, food delivery or streaming — you could earn cash back. That way, you're not leaving any money.

Also, you will be able to add a Buy It Now price for free. Sell on Craigslist Ebay is my favorite place to sell items that are easy to ship. Items that are. You can search for micro-jobs if you're looking for easy side gigs to make money online occasionally. For example, transcribing would be a solid option for you. Quick Loans from Speedy Cash. apply now. If you are like most Americans you might not have enough cash to pay for an unexpected expense. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. Some simple ways to make extra cash include participating in online surveys, selling unused items on platforms like eBay or Facebook Marketplace. Survey Pop is the fastest, easiest way for making money from your phone. 82 Start earning free money today! Your first survey pays $1 in free cash. If you need fast cash, then you need to find decent jobs that pay the same day. Fortunately, there are more options than you might expect, from delivering. 4. How can I earn extra income from home? Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. The fastest way to make quick cash without doing anything is to take surveys online. You will be required to answer a few questions to qualify for payment. One of the best ways to get cash now is through payday loans. Learn all Easy application: With all the necessary paperwork done online, it is. Key Takeaways · Selling personal belongings online—such as clothing, electronics, or books—may help you raise cash in an emergency. · Consider taking on an odd. Dormant smartphones, tablets, computers or game consoles often find their way to a desk drawer or the back of a closet. You can easily cash in on your. Online Surveys are a great way to make money while loading Netflix or when you're waiting at a restaurant for a friend. Companies often want to know what people. cash. These sites (see our top picks below) are easy to use and give instant quotes, so if you've loads to get rid of, you can speedily make extra cash. You. Cash Out. The most loved way to get paid as you work. Transfer up to $/day, up to $/pay period, to a linked bank ; Early Pay. Get your paycheck up to 2. 10 ways to earn extra cash · Hold a yard sale · Sell your stuff online · Make things to sell · Sell at a farmers market · Babysit or pet-sit · Rent out a room · Teach. Who said you can't earn money whilst enjoying your free time? Various online platforms now offer crash courses in stocks, real estate, and cryptocurrency. You might do bigger things like starting a blog or investing. You might do online tasks or even make real money playing games. Or you can use cash-back apps or. One of the best ways to make money is to get a short-term loan. However, you should be leery of loans that come with lots of challenging requirements. The more.

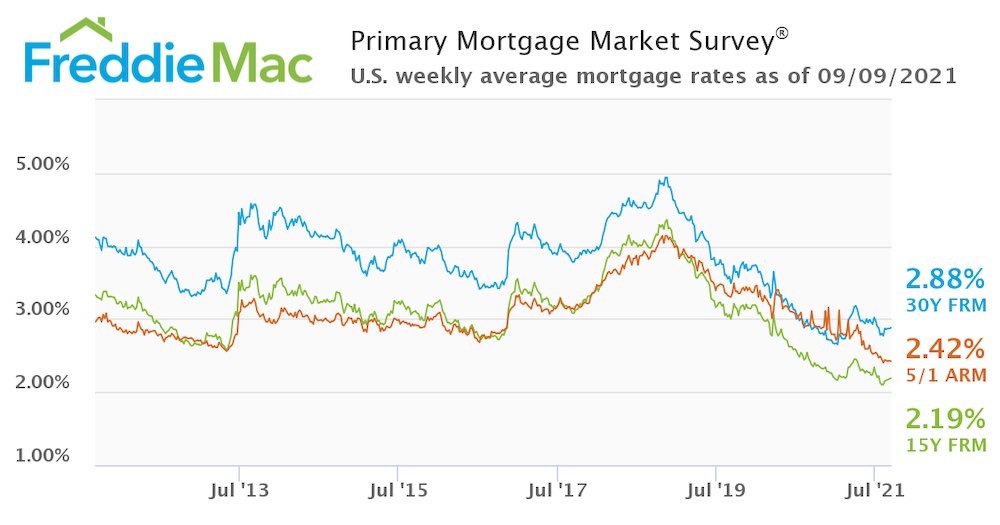

Lowest Mortgage Rates Boston

Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Adjustable-Rate Mortgages ; 7/3 ARM. 30 Years. %. 0. %. Today's mortgage rates in Massachusetts are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Great rates. Personal service. Fast turnaround. ; Fixed Rate Mortgages All other Purchase and Refinance Loans ; 30 Year Fixed. 2. 1. 0. %. %. %. Prime Rate is % as of August 5, The Annual Percentage Rate (APR) quoted is the lowest rate available as of August 5, People are accustomed to new families moving in and welcome them. One of the best things about this city is safety ratings. In the past decade, it has. Massachusetts mortgage rates today are 12 basis points lower than the national average rate of %. Track live mortgage rates ; %. 30 Year Fixed. %. %. % ; %. 15 Year Fixed. %. %. % ; %. 20 Year Fixed. %. %. Using our free interactive tool, compare today's mortgage rates in Massachusetts across various loan types and mortgage lenders. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Adjustable-Rate Mortgages ; 7/3 ARM. 30 Years. %. 0. %. Today's mortgage rates in Massachusetts are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Great rates. Personal service. Fast turnaround. ; Fixed Rate Mortgages All other Purchase and Refinance Loans ; 30 Year Fixed. 2. 1. 0. %. %. %. Prime Rate is % as of August 5, The Annual Percentage Rate (APR) quoted is the lowest rate available as of August 5, People are accustomed to new families moving in and welcome them. One of the best things about this city is safety ratings. In the past decade, it has. Massachusetts mortgage rates today are 12 basis points lower than the national average rate of %. Track live mortgage rates ; %. 30 Year Fixed. %. %. % ; %. 15 Year Fixed. %. %. % ; %. 20 Year Fixed. %. %. Using our free interactive tool, compare today's mortgage rates in Massachusetts across various loan types and mortgage lenders.

Current 30 year-fixed mortgage refinance rates are averaging: %. Today's mortgage rates in Massachusetts: % APR for a year fixed rate loan and % APR for a year FHA loan. These are lower than the national. ONE Mortgage is a year fixed rate loan with a 3 percent down-payment and some of the lowest interest rates around. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Current rates in Boston, Massachusetts are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd party. Mortgage Rates ; 30 Years, %, 0 ; 30 Years, %, 1 ; APR = Annual Percentage Rate. How do I get the best mortgage rate in Massachusetts? · Have a low debt-to-income ratio (DTI): Your DTI measures how much debt you have relative to your gross. Currently the mortgage rates in Massachusetts are % for a standard year fixed loan, % for a 15 year fixed loan and % if you are considering a 5. When you're looking for mortgage banking services in the Cape Ann Area, it pays to choose a provider who will have your best interest in mind. At Cape Ann. US News selects the Best Loan Companies by evaluating affordability, borrower eligibility criteria and customer service. Compare Massachusetts mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. The 30 year fixed mortgage gives you the best of both worlds, a low interest rate with a predictably low monthly payment. I'm trying to find the cheapest local mortgage broker with normal parameters (20% down, fixed 30 year). I've looked at many brokers in the. Get the lowest interest rates with a local mortgage lender in MA today Massachusetts Mortgage Resources and Boston Home Loans. Summary: This table. Mortgages - Adjustable Rates ; 5/1 ARM*, %, % ; 7/1 ARM**, %, %. Best Massachusetts Mortgage and Refinance Rates September ; Median home price: $,; Average year fixed rate: %; Median monthly mortgage cost. Massachusetts Mortgage Rates ; Massachusetts - 15 YR Fixed Jumbo, %, % ; Last updated on: 9/4/ PM ; Massachusetts - 30 YR FHA, %, %. 08/24/ in boston, massachusetts Apartment and multifamily loan rates from % for a HUD loan, for FHA. Multifamily real estate investing. The effective average rate across teh state for home owners is %. In the Boston metro area property taxes cost an average of $6, in Real estate. Current Mortgage Rates Massachusetts ; Year Mortgage · % · %. Learn about 30 Year Loans ➔ ; Adjustable-Rate · % · %. Learn about ARM Loans ➔.

1 2 3 4 5 6